do i have to pay estimated taxes for 2020

You expect to owe at least 1000 in tax for 2020 after subtracting your withholding and refundable credits. If you meet these IRS minimums then.

Irs If You Owe 2019 Income Taxes And Estimated Tax For 2020 You Must Make Two Separate Payments On Or By July 15 2020 One For Your 2019 Income Tax Liability

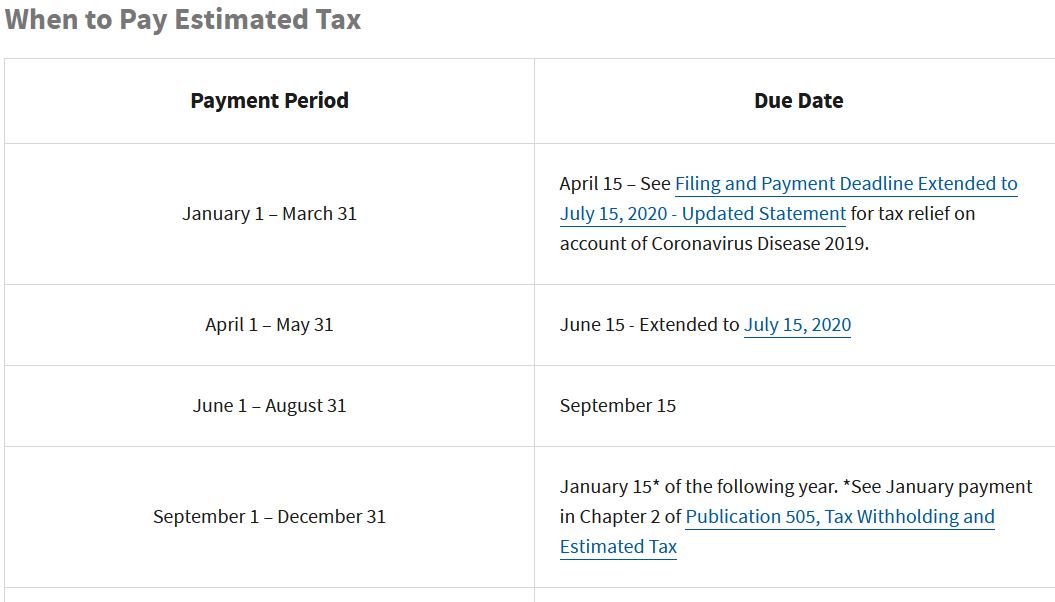

Likewise pursuant to Notice 2020-23 the due date for your second estimated tax payment was automatically postponed from June 15 2020 to July 15 2020.

. This means that taxpayers need to pay most of. You must make estimated income tax payments if you reasonably expect your tax liability for the year to exceed 1000 after subtracting your Illinois withholding pass-through withholding. If you file your state income tax return and pay the balance of tax due in full by March 1 you are not required to make the estimated tax payment that would normally be due on Jan.

Do I have to pay estimated taxes for 2020. Do I have to pay estimated taxes for 2020. You ll owe at least 1000 in federal income taxes this year even after.

If married the spouse must. The standard penalty is 3398 of your underpayment but it gets reduced slightly if you pay up before April 15. Taxpayers who estimate they will owe 200 or more in tax on income not subject to withholding must pay estimated tax.

In most cases you must pay estimated tax for 2020 if both of the following apply. If youre a calendar year taxpayer and you file your 2022 Form. You ll owe at least 1000 in federal income taxes this year even after.

75000 if marriedRDP filing separately. If you answered no to all of these questions you must make estimated tax payments using Form 1040-ES. Tax system operates on a pay-as-you-go basis.

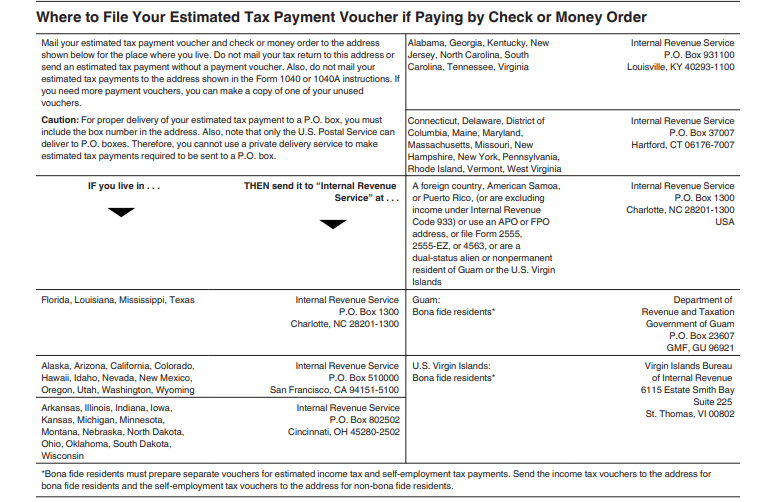

If so then youre not required to make estimated tax payments. When the annual income tax return is filed the prepaid estimated tax. There are four equal payment deadlines for this tax season.

Citizens or resident aliens for the entire tax year for which theyre inquiring. Basics of estimated taxes for individuals. 中文 繁體 FS-2019-6 April 2019.

The deadline to file Form NC-40 online to pay estimated taxes for the year 2020 is April 15. The IRS says you need to pay estimated quarterly taxes if you expect. The IRS says you need to pay estimated quarterly taxes if you expect.

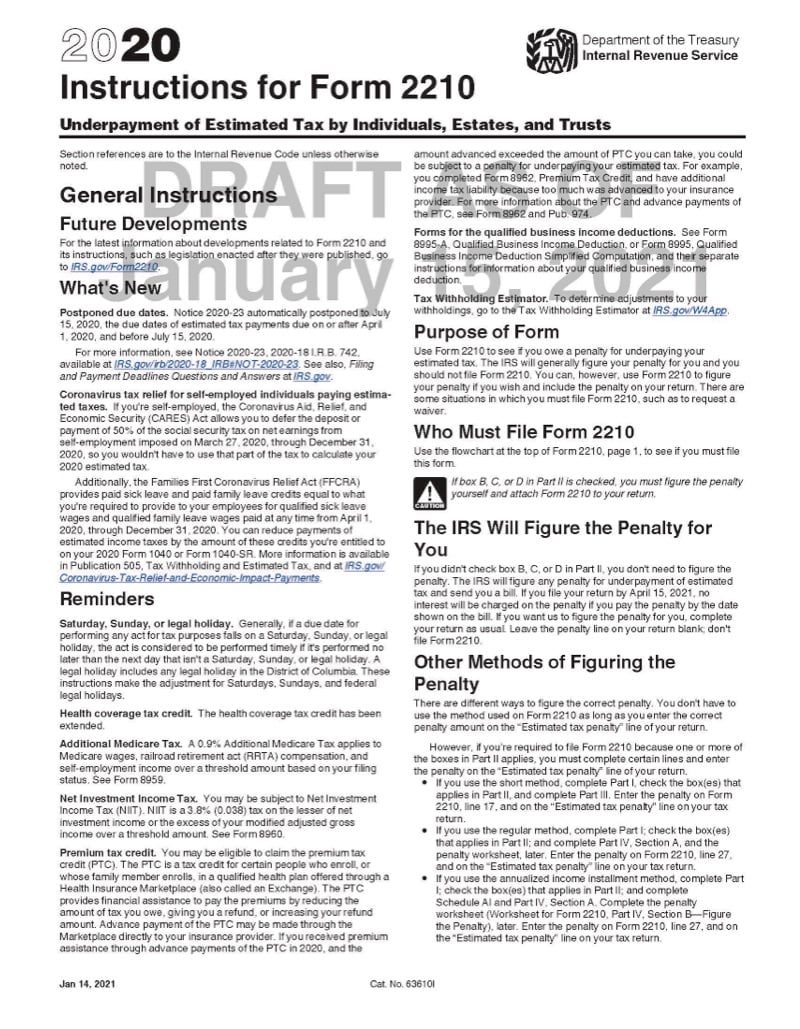

What is the underpayment penalty for 2020. Businesses that file as a corporation generally need to make estimated tax payments if they expect to owe 500 or more in tax for the current year. If youre required to make estimated tax payments and your prior year California adjusted gross income is more than.

You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022 withholding is less than 1000. Then you must base. Certain taxpayers must make estimated tax payments throughout the year.

If your federal income tax withholding plus any timely estimated taxes you paid amounts to at least 90 percent of the total tax that you will owe for this tax year or at least 100. If you estimate that you will owe more than 500 in tax for 2022 after subtracting your estimated withholding and credits then you should make quarterly estimated payments. The tool is designed for taxpayers who were US.

Qualifying farmers and fishermen must pre-pay only two-thirds 6667 of their tax or 100 of the tax shown on the tax return for the prior year whichever amount is less. Each payment must be. An estimate of your 2022 income.

Taxpayers must generally pay at least 90 percent of their taxes throughout the year through.

Where Do I Input Payment Of State Estimated Taxes For 2020 On The Turbotax State Review

Starting A Side Gig In 2022 Your New Tax Obligations Seibel Katz Cpas

For Those Who Pay Estimated Taxes Second Quarter June 15 Deadline Approaches Larson Accouting

How To Calculate And Pay Quarterly Estimated Taxes Brex

The 2021 Estimated Tax Dilemma What Tax Return Pros Are Doing And Telling Clients

Forgot To Pay Quarterly Estimated Taxes Here S What To Do

Reminder 2019 Income Tax And 2020 Estimated Tax By July 15 Asian Chamber Of Commerce

Paying Estimated Taxes In 2021 Tl Dr Accounting

Yes You Have To Pay Taxes On Your Side Gig Stash Learn

Making Irs Payments Online The Onaway

Form 2210 Penalties For Underpayment Of Estimated Taxes Jackson Hewitt

What Are Estimated Taxes Guide To 2020 Quarterly Tax Payments Swagbucks Articles

Irs Publishes Q As On Filing Deadline Extension Alloy Silverstein

Q1 Estimated Taxes Tl Dr Accounting

Safe Harbor For Underpaying Estimated Tax H R Block

Estimated Tax Due Dates Do I Still Need To Pay

How Do Estimated Taxes Work Bogleheads Org

Will You Be Subject To A Penalty For Not Filing Your 2020 Estimated Taxes Cironefriedberg Llp

Penalty Proofing Yourself From The Irs By Making Estimated Tax Payments